s corp tax rate calculator

Piscataway is located within Middlesex County. Instead you only pay payroll taxes on the salary you earn from your S corp.

5 Tax Filing Tips For College Students Tax Preparation Tax Lawyer Online Taxes

S Corporation Subchapter S and S Corp Tax Rate.

. Annual state LLC S-Corp registration fees. 44 states have a corporate income tax but South Dakota and Wyoming are the only states that do not have a corporate income. Topsearchco updates its results daily to help you find what you are looking for.

The average cumulative sales tax rate in Piscataway New Jersey is 663. Gross to Net Net to Gross Tax Year. The rates have gone up over time though the rate has been largely unchanged since 1992.

Annual cost of administering a payroll. Prepare federal and state income taxes online. The SE tax rate for business owners is 153 tax.

Federal payroll tax rates for 2022 are. This includes the rates on the state county city and special levels. We have unmatched experience in forming businesses online.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Ad Find what you want on topsearchco. For example if your one-person S corporation makes 200000 in profit and a.

2021-22 Combined FTE Calculator. Lets look at some numbers to see how this works. Most corporations must pay state income tax.

Ad E-File your tax return directly to the IRS. Max refund is guaranteed and 100 accurate. Social Security and Medicare.

An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. S-Corp or LLC making 2553 election.

If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. For example if you have a. The rate calculator reflects the rate deviation filed by Stewart Title Insurance Company.

Say you earn 150000 in revenue as the owner. Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Free means free and IRS e-file is included. Partnership Sole Proprietorship LLC. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

Estimated Local Business tax. Total first year cost of S-Corp. Start your corporation with us.

Ad Whether you have plans to crowdfund or go public well help jumpstart your corporation. 2022-23 Combined FTE Calculator. Check each option youd like to calculate for.

Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount. Being Taxed as an S-Corp Versus LLC. C-Corp or LLC making 8832 election.

Social Security tax rate. State Aid Claim Year FTE Calculator Year. However if you elect to.

OLPMS - Instant Payroll Calculator.

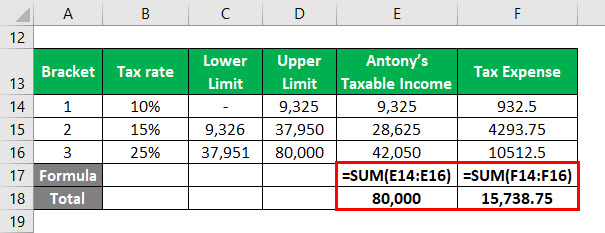

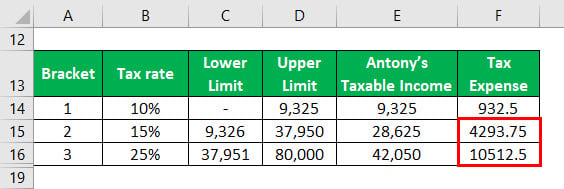

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

October 15 Extended Tax Filing Deadline Tax Time Filing Taxes Tax Season

Pin On Starting A Llc For Your Business

Salehaamir322 I Will Provide Swedish Tax Consulting For 60 On Fiverr Com Tax Consulting Consulting Tax

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Taxtips Ca Business 2020 Corporate Income Tax Rates

Who Hates Taxes The Answer Isn T What You Think Administracion Servicio A Clientes Negocios Internacionales

Corporate Tax Meaning Calculation Examples Planning

Contribution Analysis Importance Uses Calculation And More Financial Life Hacks Finance Investing Bookkeeping Business